PBS: Escaping Eritrea … [Read More...] about ካብ ውሽጢ ቤት ማእሰርታት ኤርትራ

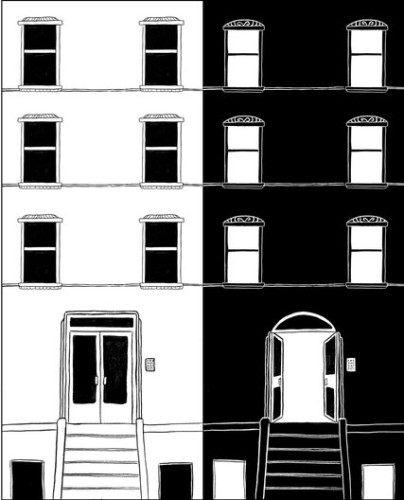

How Segregation Destroys Black Wealth

Americans commonly — and mistakenly — believe that well-to-do black people no longer face the kind of discrimination that prevents them from living anywhere they can afford. But a federal housing discrimination complaint filed last week by the National Fair Housing Alliance shows that this toxic problem is very much with us, nearly 50 years after Congress outlawed housing discrimination in the Fair Housing Act.

The complaint, and the investigations that led to it, shows how real estate agents promote segregation — and deny African-Americans the opportunity to buy into high-value areas that would provide better educations for children and a greater return on their investments.

Over the course of nearly a year, the alliance reports, black and white testers posing as home buyers had drastically different experiences when they contacted a real estate company near Jackson, Miss. Agents often declined to show properties to black customers who were better qualified than whites, with higher incomes, better credit scores and more savings for down payments. Meanwhile, white testers who had expressed interest in properties in the majority-black city of Jackson were steered into majority-white communities elsewhere.

These problems are not limited to the South. Indeed, another alliance investigation covering a dozen metropolitan areas, including Atlanta, Austin, Birmingham, Chicago, Dayton, Detroit, New York, Philadelphia, Pittsburgh, San Antonio and the District of Columbia, suggests that housing market discrimination is universal.

Despite being better qualified financially, black and Latino testers were shown fewer homes than their white peers, were often denied information about special incentives that would have made the purchase easier, and were required to produce loan pre-approval letters and other documents when whites were not.

Moreover, real estate agents enforced residential and school segregation by steering home buyers into neighborhoods based on race. Whites were encouraged to live where the schools were mainly white; African-Americans where schools were disproportionately black; and Latinos where schools were disproportionately Latino.

This behavior is reminiscent of the practices used by the real estate industry in the early 20th century that created ghettos for blacks regardless of income. As the black population grew in Northern cities, realty agents developed a variety of tools for isolating black families, including contracts that barred owners from renting or selling to “outsiders” — always a code for African-Americans.

The Federal Housing Administration, created during the New Deal to promote homeownership, openly supported these racist measures; it forbade lending to black people even as it subsidized white families that moved from the cities to the suburbs. Cut off from fairly priced home loan credit, black neighborhoods deteriorated and their values plummeted.

Many discriminatory practices were formally ended with the civil rights and fair lending laws of the 1960s and 70s. But these were quickly replaced by subtler techniques that encouraged ghettoization, like channeling black families away from white areas and banks’ and mortgage brokers’ systematically pushing middle-income black families into high-cost, high-risk loans when they could have qualified for more affordable loans.

This history of discrimination has taken an enormous toll on black wealth, as is shown in research by Douglas Massey and Jonathan Tannen at Princeton University’s Office of Population Research. In 1970, two years after the passage of the Fair Housing Act, for example, the average well-off black American lived in a neighborhood where potential home wealth, as measured by property values, stood at about only $50,000 — as opposed to $105,000 for affluent whites and $56,000 for poor whites.

By 2010, affluent African-Americans had passed poor whites in potential home wealth but had fallen further behind affluent whites. There is more than money at stake, Mr. Massey and Mr. Tannen write, because home values “translate directly into access to higher quality education given that public schools in the United States are financed by real estate taxes.”

Throughout history, ethnic groups have been able to translate economic gains into housing in better neighborhoods and advantages for their children. But for African-Americans, the researchers write, that transition has been “thwarted by segregation and the prejudice and discrimination that create and maintain it.” In other words, the damage reaches across generations and continues today.